Digital banking and financial services have fundamentally changed how customers interact with institutions. From mobile-first account opening to real-time payments and partner ecosystems, identity has become the primary security perimeter. At the same time, financial institutions face relentless pressure from fraud, regulatory scrutiny, and rising customer expectations for seamless digital experiences.

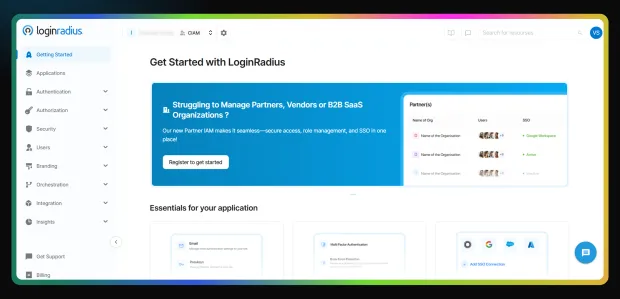

At LoginRadius, we work closely with banks, fintechs, insurers, and financial platforms that need to secure millions of customer identities without adding friction. In this article, we explain how LoginRadius Customer Identity and Access Management (CIAM) secures banking and financial identities, and what security, architecture, and compliance leaders should look for when evaluating a CIAM platform for financial services.

Identity Challenges in Banking & Financial Services

The financial sector is one of the most targeted industries for identity-based attacks. As institutions digitize services, identity threats and operational complexity grow in parallel.

Expanding Digital Attack Surface

Banks and financial platforms now support:

-

Digital onboarding and remote KYC

-

Mobile and web banking access

-

APIs for partners and embedded finance

-

Self-service account management

Each channel introduces new identity entry points that must be secured consistently.

Sophisticated Fraud and Account Takeover

Credential stuffing, phishing, SIM swapping, and social engineering remain persistent threats. Attackers increasingly combine automation with human behavior to bypass static security controls, making traditional username-password models insufficient.

Regulatory and Data Protection Pressure

Financial institutions must meet stringent regulatory requirements, including:

-

Strong customer authentication (SCA)

-

Auditability and traceability of access events

-

Regional data residency and privacy controls

Failure to secure identities can result in regulatory penalties, reputational damage, and loss of customer trust.

Balancing Security with User Experience

Customers expect fast, intuitive access to their financial services. Excessive friction during login, authentication, or recovery leads to abandoned sessions and reduced engagement — yet security cannot be compromised.

This is where a purpose-built CIAM platform becomes essential.

Evaluation Criteria: What Makes a Great CIAM Platform for Financial Services

Not all identity platforms are designed for the realities of banking and financial use cases. When evaluating a CIAM solution, financial institutions should assess the following dimensions.

Use Case Fit: CIAM vs Workforce IAM

Banking use cases center on external identities — customers, account holders, policyholders, and partners — rather than internal employees. A strong CIAM platform is optimized for:

-

High-volume consumer authentication

-

Long-lived customer identities

-

Omnichannel access across apps, APIs, and devices

Security & User Experience

Security must be layered and adaptive, not static. Key capabilities include:

-

Multi-factor authentication (MFA) with multiple factor options

-

Passwordless and passkey support

-

Context-aware and risk-based authentication

-

Secure account recovery flows

Critically, these controls must adapt dynamically to risk without disrupting legitimate users.

Architecture & Scalability

Financial platforms require:

-

Cloud-native, highly available architecture

-

Low-latency performance during peak usage

-

Support for millions of identities and transactions

-

SLAs aligned with business-critical workloads

Identity cannot become a bottleneck during high-traffic events or system integrations.

Data Residency & Compliance

Financial data is subject to strict regional and sector-specific requirements. CIAM platforms must support:

-

Regional data hosting and residency controls

-

Strong encryption and access governance

-

Compliance-aligned audit trails and reporting

Developer Experience & Integration

Banks often integrate CIAM with:

-

Core banking systems

-

KYC/AML providers

-

Fraud engines and analytics platforms

A strong developer experience — APIs, SDKs, documentation, and migration tooling — reduces implementation risk and accelerates time to value.

How LoginRadius CIAM Secures Banking & Financial Identity

LoginRadius CIAM is built specifically to address the security, scalability, and compliance needs of customer-facing financial platforms.

Strong Authentication & Access Controls

At the core of financial identity security is robust authentication.

Multi-Factor Authentication (MFA)

LoginRadius supports a broad range of MFA factors, including:

-

SMS and email OTP (with configurable policies)

-

Authenticator apps and time-based OTPs

-

Knowledge-based and possession-based factors

Financial institutions can define step-up authentication rules based on risk, transaction sensitivity, or user behavior.

Passwordless Authentication & Passkeys

To reduce reliance on passwords — a major attack vector — LoginRadius enables passwordless login flows using:

-

Email or magic links

-

One-time codes

-

Modern passkey-based authentication

This improves both security posture and login success rates.

Adaptive and Contextual Authentication

Rather than treating every login equally, LoginRadius supports adaptive authentication based on:

-

Device and location signals

-

IP reputation and velocity checks

-

Behavioral patterns

Low-risk sessions remain frictionless, while high-risk attempts trigger additional verification.

Fraud Detection & Prevention

Financial identity security extends beyond login events.

Behavioral and Anomaly Detection

LoginRadius analyzes authentication and session patterns to detect anomalies such as:

-

Unusual login times or locations

-

Rapid credential reuse attempts

-

Abnormal account behavior

These signals help identify potential account takeover attempts early.

Account Protection Controls

Built-in protections help mitigate common attacks:

-

Brute-force and credential-stuffing defenses

-

Rate limiting and bot mitigation support

-

Secure lockout and recovery mechanisms

By integrating identity security into the authentication layer, financial institutions can stop fraud before it impacts downstream systems.

Identity Data Protection & Privacy

Financial institutions manage highly sensitive personal and financial data. LoginRadius CIAM is designed with data protection as a foundational principle.

Encryption & Secure Storage

-

Identity data is encrypted in transit and at rest

-

Access to identity data follows least-privilege principles

-

Sensitive attributes can be tokenized or restricted

Consent and Preference Management

LoginRadius enables fine-grained consent capture and management, helping financial institutions comply with privacy regulations while maintaining transparency with customers.

Data Residency & Regional Controls

For institutions operating across jurisdictions, LoginRadius supports regional hosting options to align with local data sovereignty requirements.

Regulatory Compliance Support

While CIAM platforms do not replace compliance programs, they play a critical supporting role.

LoginRadius helps financial institutions demonstrate compliance readiness through:

-

Detailed audit logs of authentication and access events

-

Configurable security policies aligned with regulatory expectations

-

Support for strong customer authentication (SCA) patterns

These capabilities simplify audits and reduce operational overhead for compliance teams.

Seamless Yet Secure Customer Experience

Security should enhance trust, not hinder engagement.

Progressive Profiling

Rather than collecting excessive data upfront, LoginRadius supports progressive profiling — allowing institutions to gather identity attributes gradually as trust increases.

Self-Service Account Management

Customers can securely:

-

Manage credentials and MFA settings

-

Recover access without contacting support

-

Update profile information

This reduces call center costs while improving customer satisfaction.

Unified Identity Across Channels

LoginRadius enables consistent identity experiences across:

-

Web and mobile banking apps

-

Partner portals

-

APIs and embedded finance use cases

Customers experience one secure identity, regardless of how they interact with the institution.

Architecture Patterns & Deployment Considerations

LoginRadius CIAM is designed for modern financial architectures.

Cloud-Native & Highly Available

The platform is built to scale elastically, supporting:

-

High authentication volumes

-

Peak traffic events

-

Global user bases

This ensures identity services remain reliable even during critical business periods.

Integration with Financial Ecosystems

LoginRadius integrates with:

-

KYC and AML providers

-

Fraud and risk engines

-

Core banking and CRM platforms

APIs and event hooks allow identity signals to flow across the financial stack.

Migration from Legacy IAM

Many institutions transition from legacy or workforce-focused IAM systems. LoginRadius supports phased migration strategies that minimize disruption while modernizing security and UX.

Real-World Outcomes We See Across Financial Services

While every institution’s journey is different, common outcomes include:

-

Reduced account takeover attempts through adaptive MFA

-

Higher login success rates with passwordless authentication

-

Improved audit readiness and security visibility

-

Lower operational costs through self-service identity flows

These results reflect the value of treating identity as a strategic security layer rather than a standalone login system.

Conclusion

In banking and financial services, identity is inseparable from security, trust, and compliance. As digital interactions continue to grow, institutions need CIAM platforms that can adapt to evolving threats without sacrificing user experience.

At LoginRadius, we designed our CIAM platform to meet the realities of financial identity — high risk, high scale, and high expectations. By combining strong authentication, adaptive security, fraud protection, data privacy, and seamless customer experiences, LoginRadius helps financial institutions secure identities across every digital touchpoint.

Take the Next Step

If you’re evaluating how to modernize identity security for your banking or financial platform, our team can help you assess architecture fit, security requirements, and migration strategies.

Explore our CIAM capabilities or speak with our identity specialists to see how LoginRadius can support your financial identity roadmap.